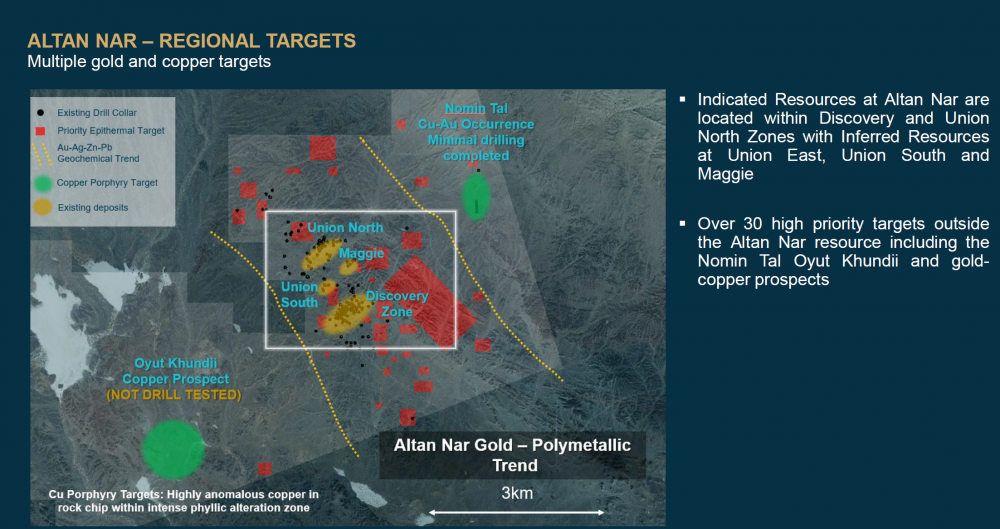

Altan Nar is located 16 km north of the Company’s Bayan Khundii gold deposit. In March 2020, Erdene secured a mining license for Altan Nar from the Mineral Resource and Petroleum Authority of Mongolia (“MRPAM”). The Altan Nar mining license covers 4,669 hectares and, in addition to the Altan Nar gold-polymetallic deposit, includes Erdene’s Oyut Khundi copper prospect and Nomin Tal copper-gold prospect. The mining license is valid for an initial term of 30 years with the ability to extend to 70 years.

Altan Nar is an intermediate sulphidation, carbonate-base metal gold (“CBMG”) deposit that remains open at depth and along the system’s known 5.6 km mineralized trend. This deposit type includes prolific gold deposits such as Barrick Gold’s Porgera mine (Papua New Guinea), Rio Tinto’s formerly producing Kelian mine (Indonesia), Lundin’s Fruta Del Norte mine (Ecuador), and Continental Gold’s Buritica project (Colombia). CBMG deposits generally occur above porphyry intrusions in arc settings and may extend for more than 500 meters vertically.

Only a small portion of the Altan Nar license has been drill tested, and 90% of the NI 43-101 Mineral Resource prepared by RPM Global in 2018 is within 150 meters from the surface and largely contained within 2 of the 18 targets with all zones remaining open along strike and at depth.

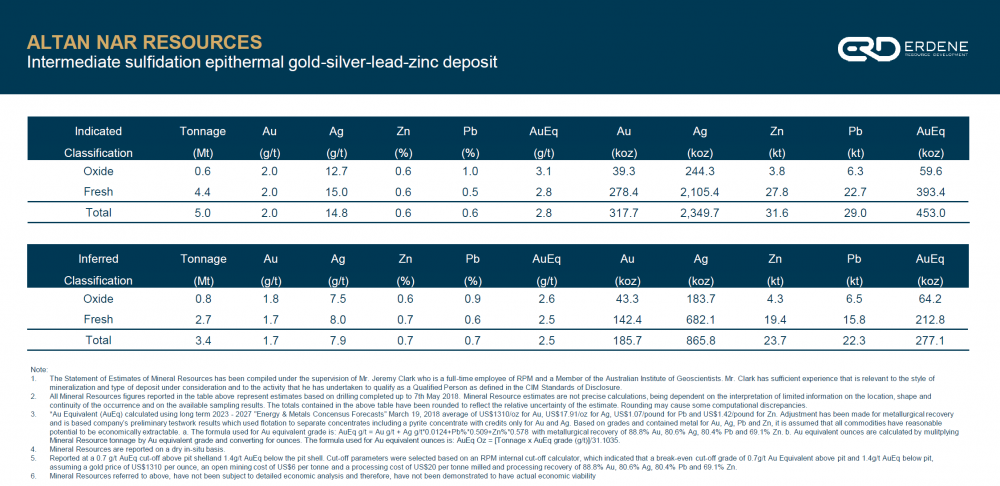

To date, Indicated Mineral Resources have been established for the Discovery Zone and Union North prospects. The remaining 16 targets at Altan Nar appear very prospective and the Company intends to complete further drilling on the license to increase its understanding of the system. RPMGlobal calculated the mineral resource estimate for Altan Nar in May 2018 at a number of gold cut-offs. However, RPM recommends reporting the Altan Nar mineral resource at cut-off of 0.7 g/t AuEq2 (see definition for AuEq2 in note 8 below) above pit and 1.4 g/t AuEq2 below the same pit shell. For further details on the Altan Nar mineral resource estimate, please see the Company’s Altan Nar Gold-Polymetallic Project NI 43-101 Technical Report dated March 29, 2021.

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist, Erdene Resource Development Corporation, is a Qualified Person within the meaning of National Instrument 43-101 and has reviewed and approved the scientific and technical information contained herein.