- Overview

- Bayan Khundii Gold Deposit

- Dark Horse Mane Gold Deposit

- Reports

- ESIA

- Illustrations

- Maps/Sections

-

Overview

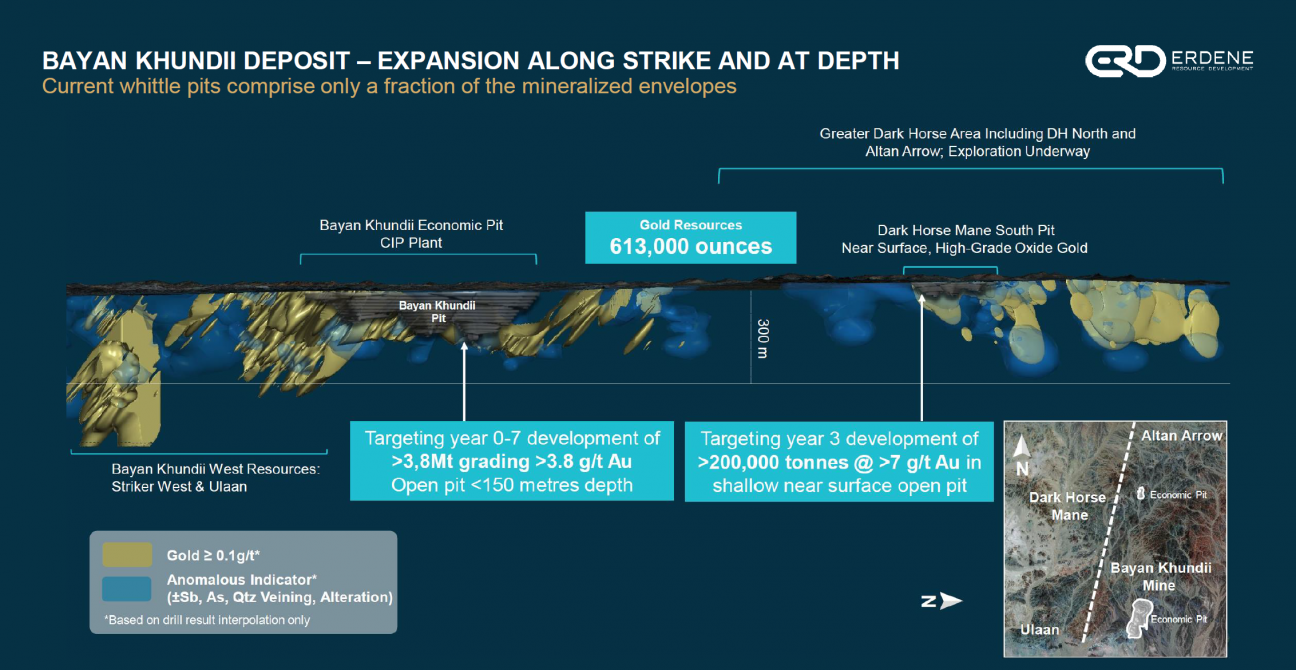

The Bayan Khundii gold deposit is located in southwestern Mongolia, within the Khundii Minerals District, approximately 16 kilometres south of the Company’s Altan Nar deposit. In August of 2019, Erdene secured a mining license for Bayan Khundii from the Mineral Resource and Petroleum Authority of Mongolia (“MRPAM”). The Bayan Khundii mining license covers 2,309 hectares and, in addition to the Bayan Khundii high-grade gold deposit, includes Erdene’s highly prospective 20 km2 greater Dark Horse prospect area, including the Dark Horse Mane high-grade gold discovery. The mining license is valid for an initial term of 30 years with the ability to extend to 70 years.

Updated Bankable Feasibility Study

In August 2023, Erdene announced the results of an updated independent Bankable Feasibility Study (“BFS”) for Bayan Khundii Gold Project. The BFS included an updated Mineral Reserve for Bayan Khundii. Please refer to the Company’s August 15, 2023 news release and the BFS NI 43-101 Technical Report for full details.

BFS highlights include:

- The 2023 BFS is based on an open-cut mining operation targeting 650,000 tonnes per year of feed material for the processing plant located directly adjacent to the open pit.

- The total mineable mineralized plant feed is 4.0 million tonnes at an average diluted head grade of 4.0 g/t gold.

- Mineralization starts at surface, with the majority of the deposit contained within the top 100 metres.

- The 2023 BFS assumes processing of ore through a conventional crush and grind circuit and a carbon in pulp plant, the design of which is based on parameters optimized by extensive metallurgical testing.

- The process circuit has been designed to maximize water recovery, using an efficient dewatering process to achieve targeted 15% moisture in tailings, minimize chemical and reagent usage and minimize environmental impact.

- Using an estimated mill recovery of 93%, total recovered gold over the life of the Bayan Khundii deposit is 476,000 ounces.

Mineral Resources and Reserves

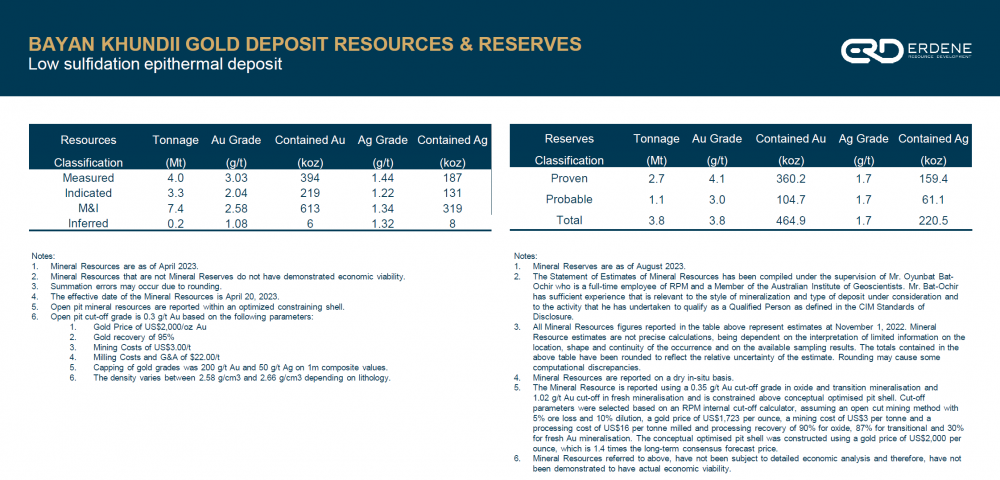

Bayan Khundii Gold Deposit – Mineral Resource Estimate, April 2023

Mineral Resource Classification

Quantity (Mt)

Gold Grade (Au g/t)

Ounces Gold (Koz)

Silver Grade (Ag g/t) Ounces Silver (Koz)

Measured

4.0

3.03

394 1.44 187

Indicated

3.3

2.04

219 1.22 131

Measured & Indicated

7.4

2.58

613 1.34 319

Inferred

0.2

1.08

6 1.32 8

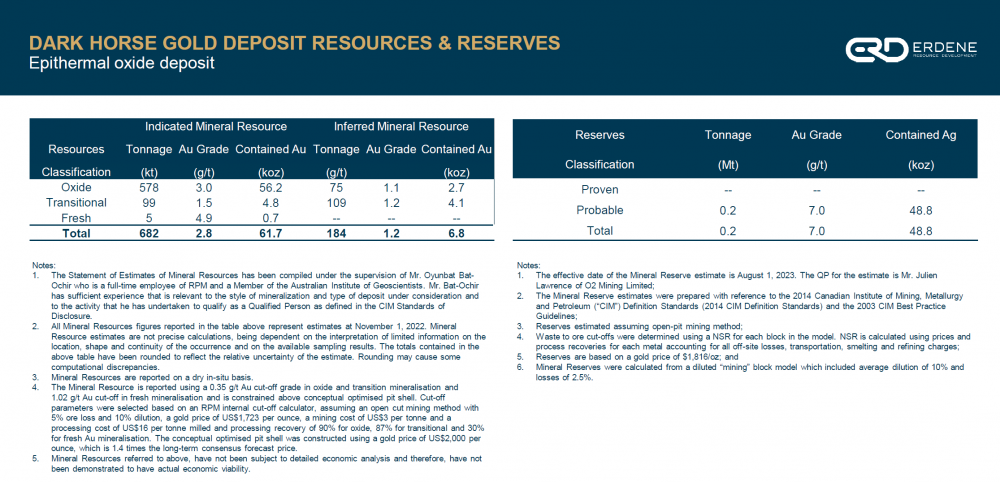

Dark Horse Gold Deposit – Mineral Resource Estimate, November 2022

Indicated Mineral Resource Inferred Mineral Resource Type

Tonnes (Kt)

Gold Grade (Au g/t)

Ounces Gold (Koz)

Tonnes (Kt) Gold Grade (Au g/t) Ounces Gold (Koz) Oxide

578

3.0

56.2 75 1.1

2.7 Transitional

99

1.5

4.8 109 1.2

4.1 Fresh

5

4.9

0.7 - -

- Total

682

2.8

61.7 184 1.2

6.8 Bayan Khundii Gold Deposit – Mineral Reserve Statement, August 1, 2023

Mineral Reserve Classification

Tonnage (Mt)

Grade (g/t Au)

Contained Gold(Koz)

Grade (g/t Ag) Contained Silver(Koz) Proven

2.7

4.1

360.2

1.7 159.4 Probable

1.1

3.0

104.7

1.7 61.1 Total Mineral Reserve

3.8

3.8

464.9

1.7 220.5 Dark Horse Gold Deposit – Mineral Reserve Statement, August 1, 2023

Mineral Reserve Classification

Tonnage (Mt)

Grade (g/t Au)

Contained Gold(Koz)

Proven

-

-

-

Probable

0.2

7.0

48.8

Total Mineral Reserve

0.2

7.0

48.8

Please refer to the Company’s NI 43-101 Technical Report for full details. The Bayan Khundii license has a 1.0% net smelter returns royalty (“NSR Royalty”) in favour of Sandstorm Gold Ltd.

Project Financing

In January 2023, Erdene entered a Strategic Alliance with Mongolian Mining Corporation (“MMC”), the Country’s largest independent miner. Under the terms of the Strategic Alliance, MMC will invest a total of US$40 million for a 50% interest in Erdene’s Mongolian subsidiary, Erdene Mongol LLC (“EM”), which holds the Khundii and Altan Nar mining licenses and the Ulaan exploration license through a three-stage transaction. Erdene will retain a 50% equity interest in EM as well as a 5% Net Smelter Return royalty on all production from the Khundii, Altan Nar and Ulaan licenses, as well as any properties acquired within five kilometres of these licenses, after the first 400,000 ounces of gold recovered.

In November 2020, Erdene announced (press release) that it executed a mandate letter with Export Development Canada (“EDC”) for an up to US$55 million senior secured debt facility to develop the Bayan Khundii Gold Project. EDC’s financing for the Project is conditional upon the satisfactory completion of due diligence.

Construction Readiness

Work to advance the Bayan Khundii Gold Project towards construction and development are ongoing. Construction readiness activities have commenced, including:

- Completed detailed design and engineering for process plant and non-process facilities

- Conducted construction, mine planning and gold processing optimization studies

- Engaged with preferred vendors and received updated quotations for major construction works and mining equipment, leveraging MMC relationships

- Completed preliminary works including camp expansion, communications infrastructure upgrade and project controls software implementation

- Expanded hazard identification program and initiated participatory environmental monitoring

- Received regulatory approval of the detailed engineering and design for the CIP process plant and integrated mineral waste facility

Environmental, Social, and Governance

- European Bank for Reconstruction and Development (“EBRD”) ESIA public disclosure period satisfactorily completed in Q3 2020;

- Received approval of Mongolian DEIA in Q4 2021.

- Renewed the Local Cooperation Agreement with Provincial and Sub-Provincial governments, committing the parties to transparently supporting community development

- Planted over 10,000 trees as part of the Company’s one million tree commitment in support of the Mongolian President’s Billion Trees Program

- Trained over 100 local residents of whom nearly 30 were employed at site in 2022

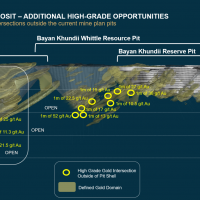

Upside Potential

The Bayan Khundii gold deposit is one of several areas of gold mineralization identified to date on the Khundii and neighbouring Ulaan licenses. Exploration results to date suggest the greater Khundii-Ulaan alteration zone, that includes the BK Deposit, Dark Horse prospect and Ulaan, are part of the same, large, gold-bearing hydrothermal system, that shows the potential to host a multimillion-ounce gold deposit. Exploration in 2022 further supports this thesis, with high-grade intercepts at Dark Horse, Ulaan SE and Bayan Khundii, and positive results from regional drilling programs. Many of these results, as well as those from drilling since the last BK resource update in 2021, are being incorporated into the updated BFS NI 43-101 Technical Report. Exploration within the Khundii-Ulaan alteration zone will continue in 2023 with additional geological mapping, geophysical studies and drilling, all designed to further grow mineral resources.

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist, Erdene Resource Development Corporation, is a Qualified Person within the meaning of National Instrument 43-101 and has reviewed and approved the scientific and technical information contained herein.

-

Bayan Khundii Gold Deposit

Overview

The Bayan Khundii Gold Deposit is located in southwestern Mongolia, within the Khundii Minerals District, approximately 16 kilometers south of the Company’s Altan Nar deposit. In August of 2019, Erdene secured a mining license for Bayan Khundii from the Mineral Resource and Petroleum Authority of Mongolia (“MRPAM”). The Bayan Khundii mining license covers 2,309 hectares and, in addition to the Bayan Khundii high-grade gold deposit, includes Erdene’s highly prospective 20km2 Greater Dark Horse prospect area, including the Dark Horse Mane high-grade gold discovery. The mining license is valid for an initial term of 30 year with the ability to extend to 70 years.

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist, Erdene Resource Development Corporation, is a Qualified Person within the meaning of National Instrument 43-101 and has reviewed and approved the scientific and technical information contained herein.

-

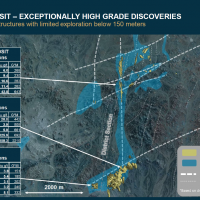

Dark Horse Mane Gold Deposit

Overview

Most of the drilling to date has been focused on the Dark Horse Mane discovered in early 2021. Erdene discovered the Dark Horse Mane, 2 kilometers north of the Bayan Khundii deposit, when initial drilling returned 6.0 g/t gold over 45 meters, beginning 10 meters downhole, including 8 meters of 27.1 g/t gold (AAD-58). Drilling over the past two years has defined a 1.5-kilometer trend of alteration and gold mineralization at Dark Horse Mane that remains open along strike to the north and south, and at depth. Highlight interceptions at Dark Horse Mane since the initial discovery include:

-

- AAD-58: 45 meters of 6.0g/t gold, including 22 meters of 12.0g/t gold.

- AAD-177: 23 meters of 11.4g/t gold, including 4 meters of 59.8g/t gold.

- AAD-178: 15 meters of 42.8g/t gold, including 5 meters of 123.5g/t gold

- AAD-146: 17 meters of 16.7g/t gold, including 3 meters of 65.0g/t gold

- AAD-137: 24.5 meters of 9.4g/t, including 13 meters of 16.1g/t gold

The Dark Horse Mane gold mineralization is associated with a north-south trending, linear structural corridor which intersects deep seated northeast trending transform faults, believed to be a conduit for primary mineralizing fluids, potentially from a magmatic porphyry source at depth. The N-S structure has been traced over five kilometers, from the southern portion of the Bayan Khundii deposit to the northern extension of Dark Horse Mane. Similar, parallel structures have also been identified east and west of Dark Horse Mane within the Greater Dark Horse area.

(Please note that these resource estimates are included within the Bayan Khundii Project Reserves and Resources).

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist, Erdene Resource Development Corporation, is a Qualified Person within the meaning of National Instrument 43-101 and has reviewed and approved the scientific and technical information contained herein.

-

-

Reports

Aug 15, 2023

Sep 1, 2020

Dec 4, 2019

Feb 4, 2019

Nov 1, 2018

Mar 26, 2018

Mar 23, 2017

-

ESIA

Jun 4, 2020

Jun 4, 2020

Jun 4, 2020

Jun 4, 2020

-

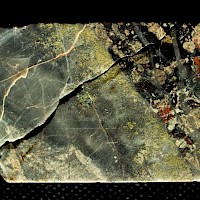

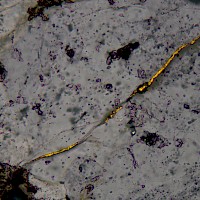

Illustrations

-

Maps/Sections